The Put Option Buying

Getting the orientation right

I hope by now you are through with

the practicalities of a Call option from both the buyers and sellers perspective. If you are indeed familiar

with the call option then orienting yourself

to under- stand ‘Put

Options’ is fairly

easy. The only change

in a put option (from

the buyer’s perspective)

is the view

on markets should be bearish as opposed to the bullish view of a call option

buyer.

The

put option buyer

is betting on the fact

that the stock

price will go down

(by the time

expiry approaches). Hence in order to profit from

this view he enters into

a Put Option agreement. In a

put option agreement, the buyer of the put option can buy the right to sell a

stock at a price (strike price) irrespective of where the

underlying/stock is trading

at.

Remember this generality – whatever the

buyer of the

option anticipates, the

seller anticipates the exact

opposite, therefore a market exists.

After all, if everyone expects

the same a market can never exist. So if the Put option buyer

expects the market

to go down by expiry, then the put option seller would expect the market (or the stock)

to go up or stay flat.

A put option buyer buys the right to sell the

underlying to the put option writer at a predetermined rate (Strike

price. This means

the put option

seller, upon expiry will have to buy if the ‘put option buyer’ is selling him. Pay attention here – at the time of the

agreement the put option seller is selling

a right to the put option buyer

where in the buyer can ‘sell’ the underlying to the

‘put option seller’ at the time of expiry.

Confusing? well, just think

of the ‘Put Option’ as a simple

contract where two parties meet today

and agree to enter into a transaction based on the price of an underlying –

➡ The party agreeing to pay a premium is called the

‘contract buyer’

and the party

receiving the premium is called the

‘contract seller’

➡ The

contract buyer pays a premium and buys himself a right

➡ The contract seller receives the

premium and obligates himself

➡ The contract buyer will decide whether or not

to exercise his right on the expiry day

➡ If the contract buyer

decides to exercise his right then he gets to

sell the underlying

(maybe a stock) at the agreed

price (strike price)

and the contract

seller will be obligated to buy

this underlying from the contract

buyer

➡ Obviously the

contract buyer will

exercise his right

only if the

underlying price is trading

below the strike price – this means

by virtue of the contract the buyer holds,

he can sell

the underlying at a much higher

price to the

contract seller when

the same underlying is trading at a lower price

in the open market.

Still confusing? Fear not, we will deal with an example

to understand this more clearly.

Consider this situation, between the Contract buyer

and the Contract Seller

➡ Assume Reliance Industries

is trading at Rs.850/-

➡ Contract buyer buys the right to sell

Reliance to contract seller at Rs.850/- upon expiry

➡ To obtain this right,

contract buyer has to pay a premium to the contract seller

➡ Against the

receipt of the

premium contract seller

will agree to buy Reliance Industries shares at Rs.850/-

upon expiry but only if contract buyer

wants him to buy it from him

➡ For example if upon expiry Reliance

is at Rs.820/- then contract

buyer can demand

con- tract seller to buy Reliance

at Rs.850/- from him

➡ This means contract buyer can enjoy the

benefit of selling Reliance at Rs.850/- when it is trading at a lower price in

the open market (Rs.820/-)

➡ If Reliance is trading at Rs.850/- or higher

upon expiry (say Rs.870/-) it does not make sense for contract buyer to

exercise his right and ask contract seller to buy the shares from him at

Rs.850/-. This is quite obvious since he can sell it at a higher rate in the open market

➡ A agreement of this sort where

one obtains the right to sell the underlying asset

upon expiry is called a ‘Put option’

➡ Contract seller

will be obligated to buy Reliance

at Rs.850/- from contract buyer

because he has sold

Reliance 850 Put

Option to contract buyer

I

hope the above

discussion has given

you the required orientation to the

Put Options. If you are still confused, it is alright as I’m certain

you will develop

more clarity as we proceed

further. How- ever there are 3 key points

you need to be aware

of at this stage –

➡ The buyer of the

put option is bearish about

the underlying asset,

while the seller

of the put option

is neutral or bullish on the same underlying

➡ The buyer of the

put option has

the right to sell the

underlying asset upon

expiry at the strike price

➡

The seller

of the put

option is obligated (since he receives an upfront premium) to buy the underlying asset at the

strike price from

the put option

buyer if the

buyer wishes to exercise

his right.

– Building a case for a Put Option buyer

Like

we did with

the call option,

let us build

a practical case

to understand the

put option better.

We will first

deal with the Put Option

from the buyer’s perspective and then proceed

to under- stand the put option

from the seller’s perspective.

Here is the end of day chart of Bank Nifty (as on 8th April 2015) –

Here are some of my

thoughts with respect to Bank Nifty –

1.

Bank Nifty

is trading at 18417

2. 2 days ago

Bank Nifty tested

its resistance level

of 18550 (resistance level highlighted by a

green horizontal line)

3. I consider 18550

as resistance since

there is a price action

zone at this level which

is well spaced in time (for people who are not familiar with the concept

of resistance.

4.

I have

highlighted the price

action zone in a blue

rectangular boxes

5. On 7th of April (yesterday) RBI maintained a status quo on the monetary rates – they kept the

key central bank rates unchanged (as you may know RBI monetary policy

is the most important event

for Bank Nifty)

6. Hence in the

backdrop of a technical resistance and lack of any key

fundamental trigger, banks may not be the flavor

of the season

in the markets

7. As result of which traders

may want to sell banks

and buy something else which is the flavor

of the season

8.

For these

reasons I have a bearish

bias towards Bank Nifty

9. However shorting futures

maybe a bit risky as the overall

market is bullish,

it is only the banking sector which is lacking luster

10. Under circumstances such as these

employing an option

is best, hence

buying a Put Option on the bank Nifty

may make sense

11.

Remember when you buy a put option you benefit when the underlying goes down

Backed by this reasoning, I would prefer

to buy the 18400 Put Option which

is trading at a premium of Rs.315/-. Remember to buy this

18400 Put option,

I will have

to pay the

required premium (Rs.315/- in this case)

and the same

will be received by the 18400

Put option seller.

Of course buying the Put option

is quite simple

– the easiest way is to call your broker

and ask him to

buy the Put

option of a specific stock

and strike and

it will be done for

you in matter

of a few seconds.

Alternatively you can buy it yourself through a trading terminal .We will get into the technicalities of buying and selling options

via a trading terminal at a later

stage.

Now assuming

I have bought Bank Nifty’s 18400

Put Option, it would be interesting to observe the P&L behavior of the

Put Option upon

its expiry. In the process

we can even

make a few

generalizations about the behavior of a Put option’s P&L.

– Intrinsic Value (IV) of a Put Option

Before we proceed to generalize the behavior of the Put Option P&L,

we need to understand the calculation of the intrinsic value of a Put option.

We discussed the

concept of intrinsic value in the previous chapter; hence I will assume

you know the concept behind

IV. Intrinsic Value represents the value of money

the buyer will

receive if he were to exercise the

option upon expiry.

The calculation for the intrinsic value

of a Put option is slightly different

from that of a call option.

To

help you appreciate the difference let me post here the intrinsic value

formula for a Call option

IV (Call option) = Spot Price – Strike Price

The intrinsic value of a Put option

is –

IV (Put Option) = Strike Price – Spot Price

I want you to remember an important aspect

here with respect

to the intrinsic value of an option

– consider the following timeline –

The

formula to calculate the intrinsic value

of an option that we have just looked at, is applicable only on the day of the expiry. However the calculation of intrinsic value

of an option is different during the series. Of course we will understand how to calculate (and the need to calculate) the intrinsic value of an option

during the expiry.

But for now, we only need to know the calculation of the intrinsic value

upon expiry.

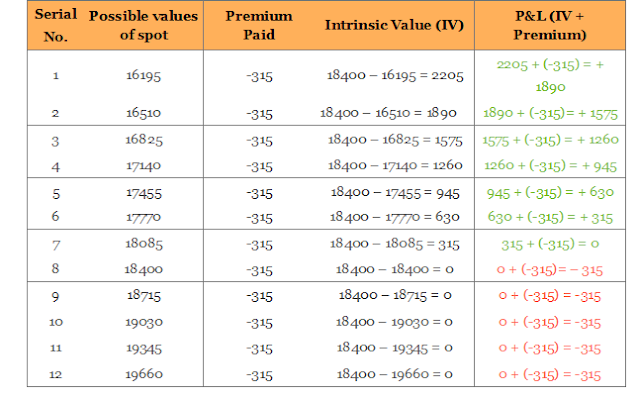

– P&L behavior of the Put Option buyer

Keeping the concept of intrinsic value

of a put option at the back of our mind, let us work towards

building a table which would help us identify how much money, I as the buyer of

Bank Nifty’s 18400 put option would

make under the various possible spot value changes of Bank Nifty (in spot market)

on expiry. Do remember the

premium paid for

this option is Rs 315/–.

Irrespective of how the spot value

changes, the fact that I have paid Rs.315/- will remain unchanged. This is the cost

that I have incurred in order to buy the Bank Nifty

18400 Put Option.

Let us keep this in perspective and work out

the P&L table

–

1. The objective behind

buying a put

option is to benefit from

a falling price.

As we can see, the profit

increases as and when the price decreases in the spot market (with

reference to the

strike price of 18400).

a.

Generalization 1 – Buyers of Put Options

are profitable as and when the spot price

goes below the strike price.

In other words

buy a put option only

when you are

bearish about the underlying

2. As the spot

price goes above

the strike price

(18400) the position starts to make

a loss. However the loss is

restricted to the extent of the premium paid, which in this case is Rs.315/-

a.

Generalization 2 – A put option

buyer experiences a loss when the spot price goes higher than the strike

price. However the maximum loss is restricted to

the extent of the

premium the put

option buyer has

paid.

Here

is a general formula using

which you can calculate the P&L from a Put Option position. Do bear in mind this formula

is applicable on positions held till expiry.

P&L = [Max (0, Strike Price – Spot Price)] – Premium Paid

Let us pick 2 random values and evaluate if the

formula works –

1. 16510

2. 19660

@16510 (spot below strike, position has to be profitable)

= Max (0, 18400 -16510)] – 315

= 1890 – 315

= + 1575

@19660 (spot above strike, position has to be loss making, restricted to premium

paid)

= Max (0, 18400 – 19660) – 315

= Max (0, -1260) – 315

= – 315

Clearly both the results match the expected

outcome.

Further, we need to understand the breakeven point

calculation for a Put Option

buyer. Note, I will take the

liberty of skipping the explanation of a breakeven point as we have already

dealt with it in the previous

chapter; hence I will give you the formula to calculate the same –

Breakeven point = Strike Price – Premium Paid

For the Bank Nifty breakeven point would be

= 18400 – 315

= 18085

So

as per this

definition of the

breakeven point, at 18085 the

put option should

neither make any money nor lose any

money. To validate this

let us apply

the P&L formula

–

= Max (0, 18400 – 18085) – 315

= Max (0, 315) – 315

= 315 – 315

=0

The result obtained in clearly in line with the

expectation of the breakeven point.

Important note –

The calculation of the intrinsic value, P&L, and Breakeven point

are all with respect to the expiry. So far in this

module, we have

assumed that you

as an option buyer or seller

would set up the option

trade with an intention to hold the

same till expiry.

But

soon you will realize that that more often than not, you will initiate

an options trade

only to close it much earlier

than expiry. Under

such a situation the calculations of breakeven point

may not matter much,

however the calculation of the P&L

and intrinsic value

does matter and

there is a different

formula to do the same.

To put this more clearly

let me assume two situations on the Bank Nifty Trade, we know the trade

has been initiated on 7th April 2015 and the expiry is on 30th April 2015–

1.

What would

be the P&L

assuming spot is at 17000

on 30th April

2015?

2.

What would

be the P&L

assuming spot is at 17000

on 15th April

2015 (or for

that matter any other

date apart from

the expiry date)

Answer to the first question is fairly simple, we

can straight way apply the P&L formula –

= Max (0, 18400 – 17000) – 315

= Max (0, 1400) – 315

= 1400 – 315

= 1085

Going on to the 2nd question, if the spot is at 17000 on any other

date apart from the expiry

date, the P&L is not going to be 1085,

it will be higher. We will discuss

why this will be higher

at an appropriate stage, but for now just keep this point

in the back of your mind.

– Put option buyer’s P&L payoff

If

we connect the

P&L points of the Put

Option and develop

a line chart,

we should be able to ob-

serve the generalizations we have made on the Put option buyers P&L. Please

find below the same –

Here

are a few things that you should

appreciate from the chart above,

remember 18400 is the

strike price –

1. The Put option

buyer experienced a loss only when the spot price

goes above the strike

price (18400 and above)

2.

However this

loss is limited

to the extent

of the premium

paid

3. The Put Option

buyer will experience an exponential gain

as and when

the spot price trades below the strike

price

4.

The gains

can be potentially unlimited

5. At the breakeven point (18085) the put option

buyer neither makes money nor losses money.

You can observe that at the breakeven point,

the P&L graph

just recovers from a loss

making situation to a neutral situation. It is only above this point the put

option buyer would start to make money.

Comments

Post a Comment