Open Interest

Open Interest

and its calculation

Before we conclude this module on “Futures Trading”, we must address

one of the questions that is

often asked- “What

is Open Interest (OI)?”, “How

is it different from Volumes?”, and

“How can we benefit

from the Volumes

and Open interest data?” Let me attempt to answer these

questions and more in this chapter. After

reading this, you will be able to interpret OI data in conjunction

with the Volumes to make

better decisions while

trading. Also, I would suggest

you refresh your understanding on Volumes from

here.

Open

Interest (OI) is a number

that tells you how many futures (or Options) contracts are currently outstanding (open) in the market. Remember

that there are always 2 sides to a trade

– a buyer and a seller. Let us say the seller sells

1 contract to the buyer. The buyer is said to be long on

the contract and the seller is said to be short on the same contract. The open interest in this

case is said to be 1.

Let me illustrate OI with

an example. Assume

the market consists of 5 traders

who trade NIFTY

fu- tures. We will

name them Arjun,

Neha, Varun, John,

and Vikram. Let us go through their

day to day trading activity

and observe how open interest varies. Please note, you need to exercise some patience

while understanding the flow of events below, else you can quite easily

get frustrated!

Lets get started.

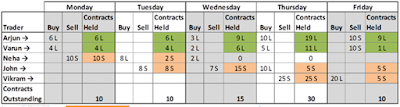

Monday: Arjun buys 6 futures contracts and Varun buys

4 futures contracts, while Neha sells

all of those 10 contracts. After

this transaction, there

are 10 contracts in total with

10 on the long side (6

+ 4) and another 10 on the

short side; hence

the open interest is 10. This is summarized in the table below.

Tuesday: Neha

wants to get rid

of 8 contracts out of the 10 contracts she

holds, which she

does.

John comes into the market and takes on the 8

shorts contracts from her. You must realize

that this transaction did not create any new contracts in

the market. It was a simple transfer from one person

to another. Hence the

OI will still

stand at 10. Tuesday’s

transaction is summarized in the table

below.

Wednesday:

To the existing 8 short contracts, John wants to add 7 more short

positions, while at the

same time both

Arjun and Varun

decide to increase their long position. Hence John sold

3 con- tracts to Arjun and 2 contracts to Varun. Note,

these are 5 new contracts created. Neha decides

to close out her open positions. By going

long on 2 contracts, she effectively transferred 2 of her short contracts to John and

hence Neha holds

no more contracts. The table now

looks like this:

By the end of Wednesday, there are 15 long (9+6) and 15

short positions in the market, hence OI stands at 15!

Thursday:

A big guy named Vikram comes to the market and sells 25 contracts. John decides to liquidate 10 contracts, and

hence buys 10 contracts from

Vikram, effectively transferring his 10 contracts to Vikram. Arjun

adds 10 more contracts from Vikram and finally Varun

decides to buy the

remaining 5 contracts from Vikram. In summary, 15 new contracts got added to the system. OI would now stands

at 30.

Friday: Vikram decides

to square off 20 of the 25 contracts he had sold

previously. So he buys 10 contracts each from Arjun

and Varun. This

means, 20 contracts in system got

squared off, hence

OI reduces by 20 contracts. The new OI is 30-20

= 10. The final summary

is listed in the table

be- low.

So on and so forth; I hope the above discussion is giving you a fair sense of what Open Interest (OI) is all about. The OI information just indicates how many open positions are there in the mar- ket. Here is something you should have noticed by now. In the ‘contracts held’ column, if you as- sign a +ve sign to a long position and a –ve sign to a short position and add up the long and short positions, it always equates to zero. In fact this is one of the primary reasons derivatives is often termed as a zero sum game!

Have a look at the following snapshot –

As

of 4th March 2015, OI on Nifty

futures is roughly

2.78 Crores. It means that there are 2.78 crore Long Nifty positions and 2.78 crore

Short Nifty positions. Also, about 55,255

(or 0.2% over 2.78

Crs) new contracts have been added today. OI is very useful in understanding how liquid the market

is. Bigger the

open interest, more

liquid the market

is. And hence

it will be easier to enter or exit

trades at competitive bid / ask rates.

– OI and Volume interpretation

Open

interest information tells

us how many

contracts are open

and live in the market.

Volume on the other

hand tells us how many trades were executed on the given

day. For every 1 buy and 1

sell, volume adds up to 1. For instance, on a given

day, 400 contracts were bought and 400 were sold, then the volume

for the day is 400 and not 800. Clearly

volumes and open interest are two

different; buy seemingly similar set of information. The volume counter starts

from zero at the start of the

day and increments as and when

new trades occur. Hence

the volume data

always in- creases on an

intraday basis. However, OI is not

discrete like volumes, OI stacks up or reduces based on the entry

and exit of traders. In fact for the example

we have just discussed, let us summarize the OI and volume information.

Notice how OI and volume change

on a daily basis. Today’s volume

has no implication on tomor- row’s volume.

However, it is not

true for OI.

From a stand-alone perspective both OI and

volume

numbers are pretty useless.

However traders generally associate these numbers

with prices to draw

an inference about

the market.

The following tables summarizes the trader’s

perspective with respect

to changes in volume and prices –

Unlike volumes,

the change in Open interest

does not really

convey any directional view on mar- kets. However

it does give a sense

of strength between

bullish and bearish

positions. The follow- ing tables summarizes the

trader’s perspective with respect to changes in the OI and prices

–

Unlike volumes, the change in Open interest does not really convey any directional view on markets. However it does give a sense of strength between bullish and bearish positions. The following tables summarizes the trader’s perspective with respect to changes in the OI and prices –

Unlike volumes, the change in Open interest does not really convey any directional view on markets. However it does give a sense of strength between bullish and bearish positions. The following tables summarizes the trader’s perspective with respect to changes in the OI and prices –

Do

note, if there

is an abnormally high OI backed by a rapid

increase or decrease

in prices then be

cautious. This situation simply means that there is a lot of euphoria

and leverage being

built up in the market. In situations like this, even a small

trigger could lead to a lot of panic in the market.

Comments

Post a Comment