Selling/Writing a Call Option

Two sides of the

same coin

Do

you remember the

1975 Bollywood super

hit flick ‘Deewaar’, which

attained a cult

status for the incredibly famous ‘Mere paas

maa hai’ dialogue :-) ? The

movie is about

two brothers from the same mother. While one brother, righteous

in life grows up to become a cop, the

other brother turns out

to be a notorious criminal whose views about

life is diametrically opposite to his cop brother.

Well, the reason why

I’m taking about

this legendary movie

now is that

the option writer

and the option buyer

are somewhat comparable to these brothers. They are the

two sides of the same coin. Of course like

the Deewaar brothers there is no view on morality when

it comes to Options

trading; rather the

view is more

on markets and

what one expects

out of the

markets. However, there is one thing that you should

remember here – whatever happens to the option seller in terms of the P&L, the exact opposite happens to option

buyer and vice

versa. For example

if the option writer is

making Rs.70/- in profits, this automatically means the option buyer is losing

Rs.70/-. Here is a quick

list of such

generalizations –

➡ If

the option buyer

has limited risk (to

the extent of premium paid),

then the option

seller has

limited profit (again to the extent of the premium he receives)

➡ If the option buyer has unlimited profit potential then the option seller potentially has unlimited risk

➡ The

breakeven point is the point

at which the

option buyer starts

to make money,

this is the

ex- act same point at which the option writer

starts to lose money

➡ If option buyer

is making Rs.X

in profit, then

it implies the

option seller is making a loss of Rs.X

➡ If the option buyer is losing Rs.X, then it

implies the option seller is making Rs.X in profits

➡

Lastly if the option

buyer is of the opinion

that the market

price will increase (above the strike price to be particular) then the option

seller would be of the

opinion that the

market will stay

at or below the strike price…and vice versa.

To appreciate these

points further it would make

sense to take a look at the Call

Option from the seller’s perspective, which is the objective of this chapter.

Before we proceed, I have to warn you

something about this

chapter – since

there is P&L

symmetry between the option seller

and the buyer, the discussion going

forward in this chapter will look

very similar to the discussion we just had

in the previous chapter, hence

there is a possibility that you could just skim through the chapter. Please don’t do that, I would

suggest you stay alert to notice the subtle

difference and the huge impact it

has on the P&L of the call option writer.

– Call option seller and his thought process

Recall the ‘Ajay-Venu’ real estate

example from chapter

1 – we discussed 3 possible scenarios that would take the agreement to a logical

conclusion –

1.

The price of the land moves above

Rs.500,000 (good for Ajay – option buyer)

2.

The price stays flat at Rs.500,000

(good for Venu – option seller)

3.

The price moves lower than Rs.500,000

(good for Venu – option seller)

If

you notice, the option buyer

has a statistical disadvantage when he buys options – only 1 possible scenario out of the

three benefits the

option buyer.

In other words

2 out of the 3 scenarios statistically benefit the option

seller. This

is just one of

the incentives for

the option writer

to sell options. Besides this natural

statistical edge, if the option

seller also has a good market insight

then the chances of the option

seller being profitable is quite high.

Please do note, I’m only talking

about a natural

statistical edge here and by no way I’m suggesting that an option

seller will always

makes money.

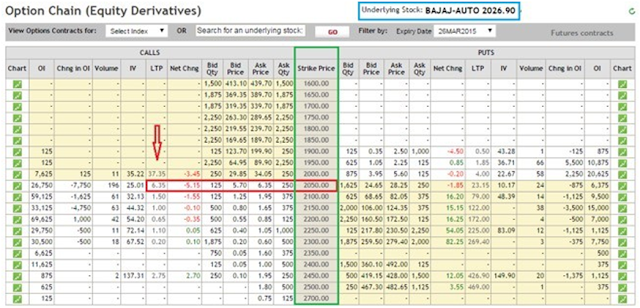

Anyway let us now take up the same ‘Bajaj

Auto’ example we took up in the previous

chapter and build a case for a call option seller and

understand how he would view the same situation. Allow me

repost the chart

–

➡ The stock has been heavily beaten

down, clearly the sentiment is extremely weak

➡ Since the stock has been so heavily beaten

down – it implies many investors/traders in the

stock would be stuck in desperate long

positions

➡ Any increase in price

in the stock will be treated as an opportunity to exit from the stuck long positions

➡ Given this,

there is little

chance that the

stock price will

increase in a hurry – especially in the

near term

➡ Since the expectation is that the stock price

won’t increase, selling

the Bajaj Auto’s call op-

tion and collecting the premium

can be perceived as a good

trading opportunity

With

these thoughts, the option writer

decides to sell a call option. The most important point to note here is – the option

seller is selling

a call option because he believes that the price

of Bajaj Auto will NOT increase in the near future. Therefore he believes that,

selling the call option and collecting the premium is a good strategy.

As

I mentioned in the previous

chapter, selecting the right strike

price is a very important aspect of options trading. We will talk

about this in greater detail

as we go forward

in this module.

For now, let us assume the

option seller decides to sell Bajaj Auto’s 2050

strike option and collect Rs.6.35/- as premiums. Please refer to the option

chain below for

the details –

Let us now run through

the same exercise that we ran through

in the previous chapter to under- stand the P&L profile

of the call

option seller and

in the process

make the required generalizations. The concept

of an intrinsic value of the option

that we discussed in the previous

chapter will hold true

for this chapter

as well.

Before we proceed to discuss the table above,

please note –

1.

The positive sign in the

‘premium received’ column

indicates a cash

inflow (credit) to the

option writer

2.

The intrinsic value of an option (upon expiry) remains

the same irrespective of call option

buyer or seller

3.

The net

P&L calculation for

an option writer

changes slightly, the

logic goes like

this

a.

When an option seller

sells options he receives a premium (for example Rs.6.35/). He would experience a loss only after he losses the entire premium.

Meaning after receiving a premium of Rs.6.35, if he loses

Rs.5/- it implies

he is still in profit

of Rs.1.35/-. Hence for

an option seller

to experience a loss he has to first lose

the premium he has

received, any money

he loses over

and above the

premium received, will

be his real

loss. Hence the

P&L calculation would

be ‘Premium – Intrinsic Value’

b.

You can extend

the same argument to the option

buyer. Since the option

buyer pays a premium, he first needs

to recover the premium

he has paid,

hence he would

be profitable over and

above the premium amount he has received, hence the P&L calculation would

be ‘ Intrinsic Value – Premium’.

The

table above should

be familiar to you now. Let us inspect the table and make a few generalizations (do bear in mind the strike price

is 2050) –

1.

As long as Bajaj Auto

stays at or below the strike price of 2050, the option seller gets to make money – as in he gets to pocket the entire premium of

Rs.6.35/-. However, do note the

profit remains constant at Rs.6.35/-.

a.

Generalization 1 – The call

option writer experiences a maximum profit

to the ex- tent of the premium

received as long

as the spot

price remains at or below

the strike price (for

a call option)

2.

The option

writer experiences an exponential loss as and when Bajaj

Auto starts to move

above the strike price of 2050

a.

Generalization 2 – The call option writer

starts to lose money as and when the spot price moves over and above the strike price.

Higher the spot price moves

away from the strike

price, larger the

loss.

3.

From the above

2 generalizations it is fair

to conclude that,

the option seller

can earn limited profits and can

experience unlimited loss

We can put these generalizations in a formula to

estimate the P&L of a Call option seller –

P&L = Premium – Max [0, (Spot Price – Strike Price)

]Going by the above formula, let’s evaluate the P&L for a few possible spot values on expiry –

1. 2023

2. 2072

3. 2055

The solution is as follows –

@2023

= 6.35 – Max [0, (2023 – 2050)]

= 6.35 – Max [0, -27]

= 6.35 – 0

= 6.35

The answer is in line

with Generalization 1 (profit restricted to the extent

of premium received).

@2072

= 6.35 – Max [0, (2072 – 2050)]

= 6.35 – 22

= -15.56

The

answer is in line with

Generalization 2 (Call

option writers would

experience a loss

as and when the spot price

moves over and above the strike price)

@2055

= 6.35 – Max [0, (2055 – 2050)]

= 6.35 – Max [0, +5]

= 6.35 – 5

= 1.35

Though the spot price

is higher than the strike,

the call option

writer still seems

to be making some money here.

This is against

the 2nd generalization. I’m sure you

would know this

by now, this is because

of the ‘breakeven point’ concept,

which we discussed in the previous

chapter.

Anyway let us inspect

this a bit further and look at the P&L

behavior in and around the strike

price to see exactly at which point

the option writer

will start making

a loss.

Clearly even when the spot price moves higher than the strike, the option writer still makes money, he continues to make money till the spot price increases more than strike + premium received. At this point he starts to lose money, hence calling this the ‘breakdown point’ seems appropriate.

Clearly even when the spot price moves higher than the strike, the option writer still makes money, he continues to make money till the spot price increases more than strike + premium received. At this point he starts to lose money, hence calling this the ‘breakdown point’ seems appropriate.

Breakdown point for the call option seller = Strike Price + Premium Received

For the Bajaj Auto example,

= 2050 + 6.35

= 2056.35

So,

the breakeven point

for a call option buyer

becomes the breakdown point for the

call option seller.

– Call Option seller pay-off

As we have seen throughout this chapter, there is a great symmetry between

the call option buyer and the

seller. In fact the

same can be observed if we plot

the P&L graph

of an option seller. Here is the same

–

The

call option sellers

P&L payoff looks

like a mirror image of the call option buyer’s P&L

pay off. From the

chart above you

can notice the

following points which

are in line

with the discussion we have just had –

1. The profit is restricted to Rs.6.35/- as long as the spot price is trading at any price

below the strike of 2050

2.

From 2050

to 2056.35 (breakdown price) we can see the profits getting minimized

3.

At 2056.35

we can see that there is neither a profit nor a loss

4. Above 2056.35 the call option

seller starts losing

money. In fact the slope

of the P&L line clearly indicates that the losses

start to increase exponentially as and

when the spot

value moves away from the strike

price

– A note on margins

Think about the risk profile of both the call option buyer and a call option seller. The call option buyer bears no risk.

He just has

to pay the

required premium amount

to the call

option seller, against which he would buy the

right to buy the underlying at a later point. We know his risk (maximum loss)

is restricted to the premium

he has already

paid.

However when you think

about the risk

profile of a call option

seller, we know that

he bears an un-

limited risk. His

potential loss can

exponentially increase as and when

the spot price

moves

above the strike price.

Having said this,

think about the stock exchange

– how can they manage the risk exposure of an option

seller in the

backdrop of an ‘unlimited loss’

potential? What if the

loss becomes so huge that

the option seller

decides to default?

Clearly the stock exchange

cannot afford to permit a derivative participant to carry such a huge default risk, hence it is mandatory for the option

seller to park

some money as margins. The

mar- gins charged for

an option seller

is similar to the margin

requirement for a futures contract.

Here

is the snapshot from the Zerodha Margin

calculator for Bajaj

Auto futures and Bajaj Auto 2050 Call option, both expiring on 30th April

2015.

And here is the margin requirement for selling

2050 call option.

As

you can see

the margin requirements are somewhat similar

in both the

cases (option writing and trading futures). Of course there

is a small difference; we will deal with it at a later stage.

For now, I just want you to note that option selling

requires margins similar

to futures trading,

and the margin amount

is roughly the same.

– Putting things together

I

hope the last four chapters

have given you all the clarity you need with respect to call options buying and selling. Unlike

other topics in Finance, options

are a little heavy duty. Hence

I guess it makes

sense to consolidate our learning at every opportunity and then proceed

further. Here are

the key things you should

remember with respect

to buying and selling call options.

With respect to option buying

➡ You buy a call option

only when you

are bullish about

the underlying asset.

Upon expiry the call

option will be profitable only

if the underlying has moved over

and above the

strike price

➡ Buying

a call option is also referred to as ‘Long on a Call Option’ or simply ‘Long Call’

➡ To buy a call option you need

to pay a premium to the option writer

➡ The call option buyer

has limited risk (to the extent of the premium

paid) and an potential to make an unlimited profit

➡ The breakeven point is the point

at which the call option

buyer neither makes

money nor experiences a loss

➡ P&L = Max [0, (Spot Price – Strike Price)]

– Premium Paid

➡ Breakeven point = Strike Price +

Premium Paid

With respect to option selling

➡ You sell a call option

(also called option

writing) only when

you believe that

upon expiry, the underlying asset will not

increase beyond the

strike price

➡ Selling

a call option is also called ‘Shorting a call option’ or simply ‘Short Call’

➡ When you sell a call option you

receive the premium amount

➡ The profit of an option seller

is restricted to the premium

he receives, however

his loss is potentially unlimited

➡ The breakdown point is the point

at which the call option

seller gives up all the premium

he has made, which means

he is neither making money

nor is losing money

➡ Since short option position carries

unlimited risk, he is required to deposit margin

➡ Margins in case of short options is similar to

futures margin

➡ P&L = Premium – Max [0, (Spot Price –

Strike Price)]

➡ Breakdown point = Strike Price +

Premium Paid

Other important points

➡ When you are bullish on a stock you can either

buy the stock in spot, buy its futures, or buy a call option

➡ When you

are bearish on a stock

you can either

sell the stock

in the spot

(although on a intraday basis), short futures,

or short a call option

➡ The calculation of the

intrinsic value for

call option is standard, it does not

change based on whether

you are an option buyer/ seller

➡ However the intrinsic value

calculation changes for a ‘Put’ option

➡ The net P&L calculation

methodology is different for the call option buyer and seller.

➡ Throughout the last 4 chapters we have looked

at the P&L keeping the expiry in perspec-

tive, this is only to help you understand the P&L behavior

better

➡ One

need not wait

for the option

expiry to figure

out if he is going

to be profitable or not

➡ Most of the option trading is based

on the change in premiums

➡ For example, if I have bought

Bajaj Auto 2050

call option at Rs.6.35 in the morning

and by noon the same is trading at Rs.9/- I can choose

to sell and book profits

➡ The premiums change dynamically all the time,

it changes because

of many variables at play, we will understand all of them as we proceed through

this module

➡ Call option

is abbreviated as ‘CE’.

So Bajaj Auto

2050 Call option

is also referred to as Ba- jaj

Auto 2050CE. CE is an abbreviation for ‘European Call Option’.

– European versus American Options

Initially when option was

introduced in India,

there are two

types of options

available – European and American Options. All index options

(Nifty, Bank Nifty

options) were European

in nature and the

stock options were American in nature. The difference between

the two was mainly in terms

of ‘Options exercise’.

European Options –

If the option type is European then it means

that the option

buyer will have to

mandatory wait till the expiry

date to exercise

his right. The settlement is based on the value of

spot market on expiry

day. For example

if he has bought a Bajaj Auto 2050 Call option, then for

the buyer to be profitable Bajaj Auto has to go higher

than the breakeven point on the day of the expiry. Even not it the option is

worthless to the buyer and he will lose all the premium money that he paid to the Option seller.

American Options –

In an American Option, the option buyer

can exercise his right to buy the op-

tion whenever he deems appropriate during the tenure

of the options expiry. The settlement is dependent of the spot market

at that given moment and not really depended on expiry. For instance he buys Bajaj Auto 2050 Call option

today when Bajaj is trading at 2030 in spot market and there are 20 more days

for expiry. The

next day Bajaj

Auto crosses 2050.

In such a case, the buyer of Baja Auto

2050 American Call

option can exercise his right, which

means the seller

is obligated to settle with

the option buyer. The

expiry date has

little significance here.

For people familiar with option you

may have this question – ‘Since we can anyway buy an op- tion now and sell it later, maybe

in 30 minutes after we purchase, how does it matter if the option is American or European?’.

Valid question, well think

about the Ajay-Venu example again. Here Ajay and Venu were to revisit the agreement in 6 months time (this is like a European Option).

If instead of 6 months,

imagine if Ajay had insisted that he could

come anytime during

the tenure of the agreement and claim his right (like an American Option). For

example there could be a strong rumor about the highway project (after they

signed off the agreement). In the back of the strong rumor, the land prices shoots

up and hence

Ajay decides exercise his right, clearly

Venu will be obligated to deliver the land to Ajay (even though he is very

clear that the land price has gone up because of strong rumors). Now

because Venu carries

addition risk of getting ‘exercised’ on any day

as opposed to the

day of the expiry, the premium he would need is also higher (so that he is compensated for the risk he takes).

For this reason, American options are always more

expensive than European Options.

Also, you maybe interested to know that

about 3 years ago

NSE decided to get rid of American option completely from the derivatives

segment. So all options in India are now

European in nature, which means

the buyer can exercise his option based

on the spot price on the expiry

day.

We will now proceed to understand the ‘Put

Options’.

Comments

Post a Comment